Dow Jones futures rose slightly late Thursday, along with S&P 500 and Nasdaq futures after the US quote. the markets were closed for Thanksgiving. Apple, Microsoft and Tesla are all in the news.

The stock market rally was positive for the second consecutive session on Wednesday. Fed officials see a slower rate hike “coming soon,” according to minutes from the Fed’s November meeting released Wednesday afternoon.

Nasdaq led, supported by Tesla’s (TSLA) rally. All major indices have risen solidly so far this holiday-shortened week. But a longer holiday for the market rally could be constructive.

Investors should be cautious when adding exposure given major technical resistance and notable economic news ahead.

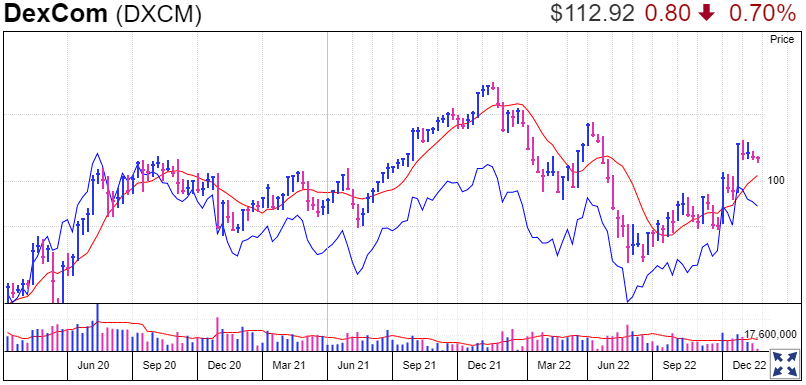

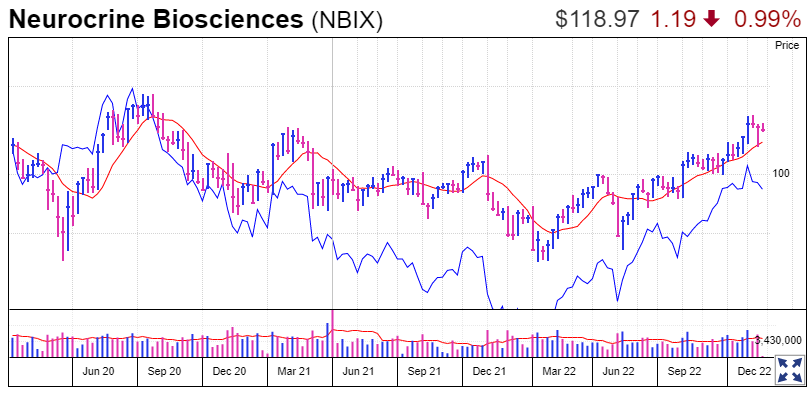

However, Dexcom (DXCM), UnitedHealth (UNH), Neurocrine Biosciences (NBIX), Medpace Holdings (MEDP) and Shockwave Medical (SWAV) are five health stocks showing interesting action.

DXCM and Neurocrine Biosciences are on the IBD list, MEDP on Watchlist. NBIX and Medpace shares are at the IBD 50.

Beta Tesla FSD

Tesla CEO Elon Musk tweeted on Thursday that the Full Self-Driving Beta is now available to all FSD owners in North America who request it.

This could allow Tesla to report more FSD deferred revenue.

Despite its name, Full Self-Driving does not offer full self-driving, but it is a Level 2 driver assistance system. The National Highway Traffic Safety Administration is investigating the safety of Autopilot and the FSD. The Justice Department is conducting a criminal investigation into Tesla’s self-driving claims.

Tesla shares jumped 7.8% to 183.20 on Wednesday, rebounding from Tuesday’s bear market lows when Citigroup upgraded the EV giant from sell to hold. TSLA shares are still down 19.5% so far this month and will drop by roughly half in 2022.

Dow Stock News

In Dow Jones stock news, Apple (AAPL) is allegedly interested in buying the UK. football giant Manchester United (MANU). The Federal Trade Commission may seek to block Microsoft’s (MSFT) deal to buy Activision Blizzard (ATVI) for nearly $69 billion.

Dow Jones Futures Today

Dow Jones futures were up a fraction vs. real value. S&P 500 futures were up 0.2% and Nasdaq 100 futures were up 0.35%.

The yield on the 10-year government bond fell 3 basis points to 3.68%.

Mainland China has reported more than 31,000 Covid cases, including those without symptoms, surpassing levels seen in mid-April during the Shanghai lockdown. Symptomatic Covid infections are still below April highs.

OUR. stock markets were closed on Thursday for the Thanksgiving holiday. On Friday, the US stock exchanges will close earlier, at 1 pm. E.T. But other exchanges around the world are normally open on Thursdays and Fridays.

Note that overnight action in Dow futures and elsewhere does not necessarily translate to actual trading on the next regular exchange.

stock market rally

The stock market rally faltered on Wednesday but extended technical-led gains.

Initial claims for jobless benefits rose to a three-month high, while continuing claims hit an eight-month high. S&P Global Purchasing Managers’ Indexes for the US both manufacturing and services signaled decline.

The Fed minutes raised expectations for a 50 basis point rise in interest rates in December. 14 meetings. Markets still favor another half point move in February, but there is a decent chance of a quarter point increase.

The Dow Jones Industrial Average was up 0.3% in Wednesday’s trade. The S&P 500 rose 0.6%, led by TSLA shares. The Nasdaq Composite is down 1%. The small-cap Russell 2000 gained 0.1%.

OUR. Oil prices fell 3.7% to $77.94 a barrel. Natural gas futures rose 7.2%.

The yield on the 10-year government bond fell 5 basis points to 3.71%. The two-year Treasury yield, more closely linked to the Fed’s rate hike prospect, fell below 4.5%.

United States. The greenback fell sharply for the second consecutive session, returning close to recent lows.

ETFs

The iShares Expanded Tech-Software Sector (IGV) ETF rose 1.5%. The VanEck Vectors Semiconductor ETF (SMH) gained 0.9%.

The SPDR S&P Metals & Mining ETF (XME) gained 0.3%. OUR. The Global Jets ETF (JETS) was up 0.1%. The SPDR S&P Homebuilders ETF (XHB) was up 0.5%. The Energy Select SPDR ETF (XLE) was down 1.1%. The SPDR Fund in Select Healthcare Sector (XLV) was up 0.4%. Dow Jones’ giant UNH is the leading holding in XLV.

The ARK Innovation ETF (ARKK) jumped 2.9% and the ARK Genomics ETF (ARKG) jumped 0.9%, reflecting more stocks from speculative stories. TSLA shares are the primary holding in Ark Invest’s ETFs.

Events to watch

Dexcom shares advanced 1.7% to 112.92, finding support at the 21-day moving average. DXCM shares stalled this month after gains in October. 28. Dexcom stock has likely traded a long time with a buy point of 123.46 in a seven month trading range. Investors could buy DXCM shares from an early entry at the 21-day line, perhaps using Tuesday’s high of 113.88 as a specific buy point.

Medpace shares fell 1.3% to 218.81 on Wednesday. The stock is consolidating near record highs since October, when it surged 38%. 25 subsequent earnings. Since then, MEDP stock has been forging a messy handle into the cup’s deep base all year round. While the stock has seen large intraday swings, MEDP shares are currently on track to form a tight three-week pattern ahead of Friday’s close. Investors can use Nov. 15 closed at 226.57 on early entry, above most recent trading.

NBIX shares fell 1.5% to 118.97. Equities are consolidating near multi-year highs, extended since the October breakout. Despite last week’s drop to the 50-day mark, Neurocrine stock is in a tight three-week pattern that is on track for a fourth week. Technically it has a buy point at 126.09, although traders might want to wait for some quieter action.

Shares in Shockwave jumped 4.7% to 264.06 on Wednesday, moving back above the 21-day mark but hitting resistance at the 50-day mark. After a failed breakout in late October and a strong sell-off that continued into gains, SWAV stock rallied over the past week. The new base will take longer, but aggressive traders can use a strong move above the 50-day period as an early entry.

UNH shares rose 1.3% to 529.71, bouncing above the 50-day and 21-day levels after briefly undermining its 200-day level last week. UnitedHealth shares used to be long-term leaders in IBD and still share many traits. Investors can use the 50-day rally line as an early entry or as a long-term leader entry. UNH stock needs to make a new base after failing quickly to break out of a handle mug base last month.

Market rally analysis

A stock market rally added to Tuesday’s gains. The S&P 500 has just beaten its November high. 15 intraday high and closed within 1% of its 200-day line.

The Russell 2000 has reached its 200-day mark.

The Nasdaq contributed to Tuesday’s bounce off its 21-day moving average, although it’s still below its November high. 15 short-term high and well below its 200-day high.

The Dow Jones reached 20 points since August. 16 intraday max.

The S&P 500 moving steadily above its 200-day line — which roughly coincides with the annual downtrend line — is a major test for the market’s recovery.

The flood of economic data could shake the expectations of the Fed and therefore the stock market. On Wednesday, November 30th, the JOLTS report will show job openings, with Fed Chairman Jerome Powell speaking later in the day. On Thursday, the PCE price index, the Fed’s favorite inflation gauge, will be released, along with jobless claims and the ISM manufacturing index. The November jobs report is due out on Friday, February 11th.

Ideally, the market would pull back for a few days and let at least the 21-day mark recover and move on to this economic news.