The world of fintechs – short for fintech companies – can offer investors interesting opportunities. Fintechs include those that create and manage peer-to-peer (P2P) payment applications, as well as those that create innovative digital banking tools.

The fintech industry was valued at $110.57 billion in 2020 and is expected to reach $698.48 billion by 2030, according to Allied Market Research. When it comes to buying shares in a fast-growing industry like fintechs, it’s important to understand the size of the business, how it works and what competitive advantages it has.

Investing in fintech by the numbers

The fintech industry is expected to grow to $698.48 billion by 2030, an increase of $587.91 billion from 2020.

Digital payment services are the most prominent among fintech developments, accounting for over 80% of global fintech revenues.

Companies in the Asia-Pacific region are expected to be the fastest growing in the fintech sector.

Since September 2018, fintech stocks have consistently outperformed other financial services prices – after COVID-19 hit global markets, fintech stock prices rebounded in just four months, while traditional financial services prices still had not fully recovered by the end of 2020.

US-based Visa is the largest fintech company by market capitalization, with a total value of around $383.3 billion.

The second-largest fintech by market capitalization is China-based Ant Financial, valued at around $312 billion.

About 3 in 4 consumers worldwide have used a fintech money transfer or payment service at least once.

China is at the forefront of fintech consumer adoption – in 2019, it was reported that 92% of Chinese citizens used fintech banking and payment services.

In the US, fintech is developing – US participation. Consumers using fintech increased from 58% to 88% between 2020 and 2021.

Sources: Allied Market Research, Deloitte, Center for Finance, Technology and Entrepreneurship (CFTE), EY and Plaid

What is fintech?

Fintech describes an industry focused on using technology to develop and improve financial products and services. Fintechs often offer exclusive services that simplify and streamline the financial life of consumers.

There is a good chance that fintech is already part of your life. If you’ve ever felt a payment from Venmo, traded stock with Robinhood, or used your debit card at a store that uses Block to process payments, you’re already familiar with at least part of the scope of fintech. Banking, investment apps, and payment processing services are just some of fintech’s functions.

Some niche fintechs have also developed financial services with a focus on social causes in recent years. For example, Stretch is a fintech that offers bank accounts and financial resources to ex-convicts. Meanwhile, Atmos is a fintech focused on fighting climate change, using its deposits to lend exclusively to renewable energy and other climate-positive initiatives.

Fintech development is driven by different types of technology, including:

- Artificial intelligence

- Blockchain

- cloud computing

- date

- types of fintechs

- Some of the more common types of fintech services include, but are not limited to:

Banking: Fintech banking consists of various apps and software that allow consumers to open accounts, protect their accounts from fraud and receive direct deposits faster. Examples include Chime and Current.

Payments: Payment services are the most common fintech offering, according to Deloitte. Digital payments allow consumers to pay bills, make purchases using contactless payment methods and send money to colleagues. Some examples include Venmo, Zelle, PayPal, and Block.

Financial management: Fintechs in this category are designed to make it easier for consumers to manage their personal finances, offering services such as expense tracking and automatic savings. Financial management fintechs include Digit, Mint and You Need a Budget.

Investments: These fintech companies are designed to help investors grow their assets, track their investments and use robotic advisors. Popular investment fintechs include SoFi, Acorns, Robinhood and Wealthfront.

Lending: Lending fintechs simplify the lending process for lenders and borrowers. They can give lenders access to potential borrowers’ information to make credit decisions and provide borrowers with maturing loans or plans.

flexible payment methods. Some examples of these fintechs include Plaid, Affirm and Klarna.

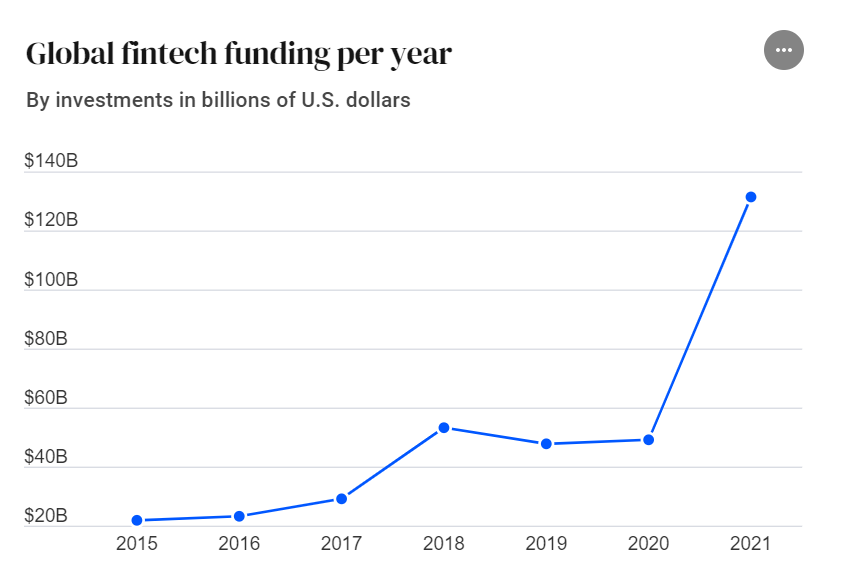

fintech expansion

In 2021, the fintech industry will see an increase of $89.5 billion (168%) in funding over the previous year, totaling $131.5 billion, according to CB Insights’ “State of Fintech” report. . An increase in funding was seen across all major fintech types, indicating a broad increase in interest across the fintech industry.

One of the fastest-growing fintech categories is digital lending, which, according to CB Insights, has seen a 220% increase, or nearly $15 billion, between 2020 and 2021. The market research firm also informs USA. leads the world in fintech funding, accounting for an estimated $62.9 billion in global fintech funding, up 171% over the previous year.

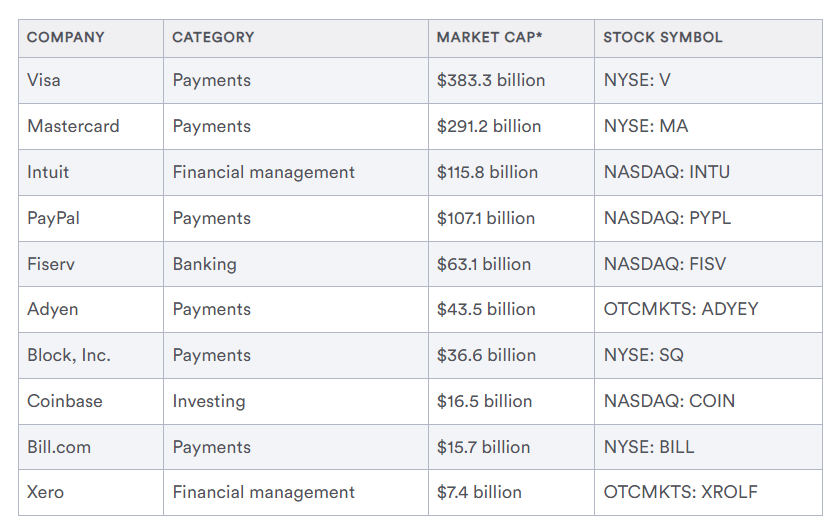

Top fintech companies

When choosing which stocks to invest in, it is important to do your research. See the company’s business model and history, what is driving the industry and what trends are coming to the fintech world.

Accounting firm KPMG notes some trends to watch out for in 2022:

- Mergers and acquisitions on the rise, with more fintech companies looking to expand into different markets

- Focus more on the social and environmental impact of companies

- Greater demand for banking alternatives and new banking technologies

- The main publicly traded fintechs on the market include:

The best fintech ETFs

An exchange-traded fund (ETF) is a type of investment where an investor holds a small stake in many different assets. Investing in ETFs is a great way to diversify your portfolio and reduce risk.

ETFs are publicly traded like stocks and charge a low fee based on a percentage of the money invested in the fund.

With the growth of the fintech market, there are several ETFs specifically focused on investing in leading fintech companies. These funds allow investors to hold stakes in the fintech sector without having to pick individual stocks to see which will win. A passive investment strategy with fintech ETFs can lead to high returns.

Fintech ETFs that can give you exposure to cutting-edge advances in finance include:

Ark Fintech Innovation ETF: The fund is a leader in fintech ETFs and its key holdings include Shopify and Block, Inc.

Global X Fintech ETF: One of the oldest and most well-established fintech funds, Global X Fintech ETF’s top holdings include Intuit and Fiserv.

ETFMG Prime Mobile Payments ETF: This fund focuses on mobile payments companies, with major holdings including Paypal and Visa.

Amplify Emerging Markets Fintech ETF: The Amplify Emerging Markets Fintech ETF carries more risk because it focuses on emerging markets, which tend to be more volatile. Its largest holdings include PagSeguro, a Brazilian digital payments company, and MercadoLibre, Inc.

The future of fintechs

Fintechs have seen a significant rise in recent years and are not expected to slow down anytime soon, with Allied Market Research predicting that the global fintech industry will be worth $698.48 billion by 2030.

While digital payment fintech accounts for the majority of global fintech revenue, other fast-growing categories include digital lending and central bank replacements. Affirm, Klarna and SoFi are some of the leaders in digital lending, while Thought Machine and Temenos are the top banking fintechs.

KPMG also predicts that companies focused on climate change and sustainability will see significant growth in the coming years. Investors may want to keep an eye out for companies tackling such global issues.

Meanwhile, many fintechs are doing more business in underdeveloped regions. For example, funding in Latin America will hit a record $13 billion in 2021, up 269% from the previous year, according to CB Insights. These emerging markets could prove to be highly profitable in the years to come.

Final result

Fintechs are one of the fastest growing and most exciting industries, offering services that help consumers and businesses manage their finances, access loans and make payments.

As technology continues to change the way we live and affect different areas of finance, it will be necessary to regularly assess investments and consider what competitive advantages individual fintechs have. Fintech ETFs can be a good opportunity for investors who want to tap into the growth potential of companies at the forefront of innovative technologies with slightly lower risk.