Stocks rose on Wednesday after minutes from the Federal Reserve’s latest meeting signaled a likely slowdown in the pace of central bank rate hikes next month.

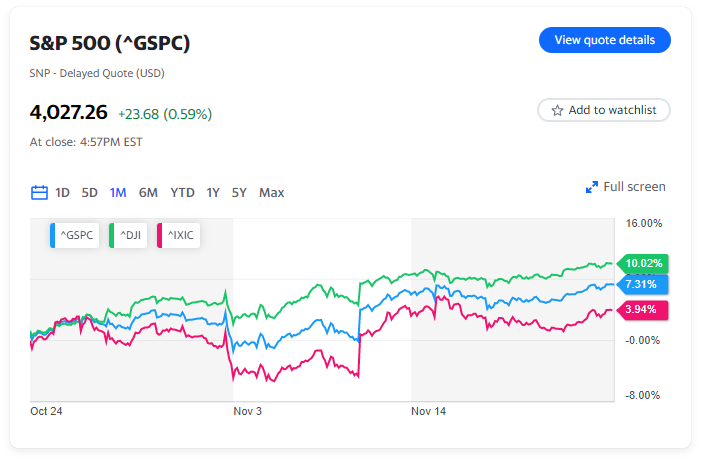

When the closing bell rang on Wall Street, all three major indexes were in the green, with the S&P 500 up 0.6%, the Dow up 0.3% and the Nasdaq up 1%.

Wednesday marked the last full trading session of the week for the US. investors. OUR. the markets will be closed on Thanksgiving and on Black Friday the markets will only be open for half a day.

The biggest move in markets on Wednesday came from energy markets, with WTI crude falling 4.3% to $77.47 a barrel. Oil prices fell as low as $77.10 during the day, approaching one-year lows.

Markets reacted Wednesday afternoon to the Fed’s statement that “various participants” said it “would be appropriate to slow the pace of increases in the target range for the federal funds rate.”

Last month, the Fed raised its benchmark interest rate target range by 0.75% for the fourth straight meeting. Markets expect a 0.50% rise in that range at next month’s Fed meeting.

Elsewhere on the calendar, Wednesday was a busy day for economic data, with data on the labor market, housing market and manufacturing sector being released on Wednesday.

The latest data on weekly jobless claims showed that 240,000 new jobless claims were filed last week, the most since mid-August. Economists had expected initial claims to total 225,000 for the week ended Nov. 19.

Durable goods orders for October were also released on Wednesday, showing orders rose 1% last month, against expectations for a 0.4% increase, according to Bloomberg data.

Preliminary data from S&P Global on business activity for November showed a continued slowdown in economic performance, with the firm manufacturing PMI falling to a 30-month low, while activity in the services sector hit a three-month low. S&P Global Market Intelligence chief business economist Chris Williamson said on Wednesday the news was consistent with the economy contracting 1% on the year.

Consumer sentiment data from the University of Michigan showed consumers remain uncertain about their outlook, with the Index down 5% since October to 56.8 from 59.9. “Along with the persistent impact of inflation, consumer attitudes have also been hurt by rising borrowing costs, falling asset values and weakening job market expectations,” said Joanne Hsu, director of consumer research.

In real estate, new home sales rose an unexpected 7.5% in October to an annualized rate of 632,000, much faster than the annual rate of 570,000 expected by economists. Mortgage rates have also fallen slightly this week, remaining below recent highs.

Recent stock momentum continues

After the S&P 500 closed above 4,000 points for the first time in two months on Tuesday and the Dow closed at a three-month high, investors continued to build on that positive momentum on Wednesday.

Last month, the Dow rose nearly 10%, while the S&P 500 rose more than 6.5%. The tech-heavy Nasdaq remains lagging, rising less than 3% over the period as higher rates and the collapse of crypto markets weigh on the tech industry as a whole.

Still, the recent market action has some strategists turning more optimistic towards the end of the year, even as senior teams at Morgan Stanley and Goldman Sachs issued more cautious stock market outlooks this week.

“The market is like a coil spring,” Brian Belski, chief investment strategist at BMO Capital Markets, told Yahoo Finance Live on Tuesday. “I think the market will continue to… go up. I really think there’s a good chance we’ll be well above 4,000 [in the S&P 500] by the end of the year.”

Belski has a year-end price target of 4,300 on the S&P 500, meaning the index could gain about another 8% by the end of this year.

Across crypto markets, the fallout from the FTX meltdown continues to reverberate across the industry, although the price of Bitcoin rose by several percentage points on Wednesday, trading near $16,500. Late Wednesday afternoon, disgraced FTX founder and former CEO Sam Bankman-Fried said he would attend the New York Times Dealbook conference next Wednesday, his first public appearance since the company was launched sa filed for bankruptcy earlier this month.

On Tuesday, Digital Currency Group, parent of troubled Genesis Global exchange, became the latest major cryptocurrency player to come forward and reassure investors that bankruptcy is not imminent.

In a memo to DCG staff, CEO Barry Silbert said the decision to halt buybacks and new activity at Genesis last week resulted from a “liquidity and duration mismatch in Genesis’ loan book.”

Silbert revealed that the intercompany loans were made between DCG and Genesis, but that these loans were likely made “in the same way as hundreds of crypto investment companies.”

On the earnings side, Wednesday morning results for Deere & Co. (DE) sent stocks up 5% as the agricultural giant reported earnings that beat expectations.

Other moves on Wednesday included names that posted results after Tuesday’s close, including HP (HPQ), Nordstrom (JWN) and Autodesk (ADSK).

HP shares rose 1.8% on Wednesday after the company said it plans to cut its workforce by as much as 12%, or 6,000 jobs, by the end of fiscal 2025 in response to a market downturn. of PCs.

Nordstrom shares fell 4% on Wednesday after reporting last-quarter sales and predicting lower earnings for the full year.

Autodesk shares fell more than 5.5% after the company cut its revenue and cash flow outlook this year, citing “less demand for upfront multi-year contracts and more demand for annual contracts than we expected”.