This year is currently looking like one of the toughest ever for the stock market.

During the first nine months of 2022, the S&P 500 lost 23.9%. Just five full calendar years produced worse returns: the three years since the Great Depression, 2008 and 1974.

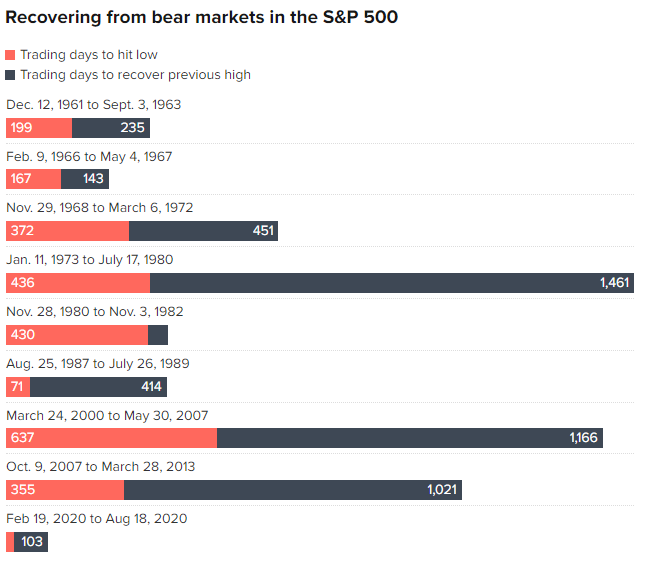

But if market history paints an ominous picture of what is happening this year, it also offers a silver lining for long-term investors. Bear markets like the current one tend to be short-lived, and investors who keep their cool tend to do well.

That’s what Charles Rotblut, vice president of the American Association of Individual Investors, pointed out in a recent tweet. “Not only is the current bear market within the typical range of previous bears, but those who maintain their allocations are being rewarded,” he wrote.

There have been 13 previous bear markets in the U.S. prior to this year's drop.

Not only is the current bear market well within the typical range of past bears, those who stick w/ their allocations get rewarded for doing so.

H/T @StovallCFRA for the data.

#stockmarketcrash pic.twitter.com/QcMnzfNHeB

— Charles Rotblut, CFA 🏃♂️ (@CharlesRAAII) September 27, 2022

The data he refers to comes from CFRA’s chief investment strategist Sam Stovall, who has analyzed 13 bear markets — defined as declines of 20% or more from market highs — since 1945.

The current bear falls into what Stovall calls “garden variety” bear markets – those that see the stock market drop between 20% and 40%. Others he calls “mega-metaldown”, bears that have had drops of more than 40%.

The latter type is particularly challenging for investors, lasting less than two years on average with an average decline of 51%.

A garden bear is a little less intimidating. The average drawdown in these periods is 27% and they usually last an average of 13 months. More importantly for investors, it took just 27 months, on average, for stocks to return to their peaks after these downturns. This compares to an average recovery time of nearly five years for stronger bears.

Two years can seem like a long time to look at red numbers in your portfolio, and five can seem like an eternity. But if you’ve been investing for decades, a period of a few years is a swing.

More importantly, it would be wise to add to your portfolio during bear markets rather than sell, says Rotblut.

“Have you ever looked at a chart and thought, ‘Would you like to buy that stock when it was low at this price?’ So why aren’t you shopping now?” he says. “Nobody knows where the fund is, but we do know the stock is for sale now.”

The bottom of the market could be far into the future and selling now, before things get worse, could boost your returns in the long run. But that would likely be a mistake, experts say, for two reasons.

First: even if you are certain that the market is falling further, selling now would require you to time the reversal right to make a profit. “If you’re going to make money, what’s your rule for getting back on the market? What are you going to use as a brand? And what happens if you don’t act?” says Rotblut.

Market timing is extremely difficult and getting it wrong can hurt your returns. A $10,000 investment in a fund that tracks the S&P 500 in late 2006 would increase to nearly $46,000 by the end of 2021, according to Putnam Investments.

But subtract the first 10 days from that 15-year period and the total drops to about $21,000. “Time, not timing, is the best way to measure gains in the stock market,” say the Putnam researchers.

The second reason: while past returns are no guarantee of future results, markets have historically rewarded investors for buying into the market after it has had the kind of decline investors have seen so far this year.

Measured by the Wilshire 5000 – the wide map of the USA. stock market index – the first nine months of 2022 are among the 20 worst nine-month periods of the last half century, according to data from Compound Capital Advisors.

The Wilshire 5000 was down 25.9% in the last 9 months, one of the worst 9-month periods for stocks in the last 50 years.

Has selling AFTER large 9-month declines been a good strategy for long-term investors in the past? No.

Here's the data… pic.twitter.com/OjZnHMF7qc

— Charlie Bilello (@charliebilello) October 3, 2022

In all but one case, the index showed a positive one-year return after a nine-month decline, with an average return of 12%. In the following three years, the index was always positive with an average gain of 41%.

Just post a tweet from Compound CEO Charlie Bilello: “Was selling AFTER big 9 month dips in the past a good strategy for long term investors? About.”